Introduction to the Voluntary Carbon Market

Welcome to Low Carbon Trade, a revolutionary trading platform designed to make the voluntary carbon market an effective tool in combating climate change. In this blog post, we’ll go into the fundamentals of the voluntary carbon market, a critical tool for businesses, organizations, and individuals aiming to offset their carbon emissions. We’ll explore how the market works, explain the difference between carbon credits and offsets, and discuss the types of projects that generate these credits.

What is the Voluntary Carbon Market?

The voluntary carbon market allows businesses, organizations, and individuals to offset their carbon emissions by purchasing carbon credits. Each credit represents one metric ton of reduced, avoided, or removed CO2 or equivalent greenhouse gases. These credits can be bought from projects that focus on reducing greenhouse gases in the atmosphere, such as reforestation, renewable energy carbon credits, and technological carbon capture solutions.

Compliance and voluntary carbon markets have developed in parallel, with key developments such as the Kyoto Protocol in 1997 and the Paris Agreement in 2015. At COP26, the rules relating to Article 6, concerning carbon markets, were agreed. Both types of carbon markets have the potential to incentivize positive environmental outcomes and finance projects that cap, reduce, or remove GHGs.

What are Carbon Credits?

A carbon credit represents one metric ton of carbon dioxide (CO2) avoided or removed from Earth’s atmosphere. Carbon credits are tradeable units sold by project developers that have been created with the purpose of reducing, avoiding, or removing GHGs in the Earth’s atmosphere. Each carbon credit is measured as one ton of carbon dioxide (CO2) or an equivalent GHG that is or will be avoided or removed from the atmosphere. Carbon credits are essential in the carbon credit market and serve as a key tool in carbon trading.

Carbon Credits vs. Offsets

A carbon credit is not necessarily a carbon offset. A carbon credit only becomes a carbon offset when it is retired to compensate for a company’s or individual’s greenhouse gas emissions (GHGs). Owners of carbon credits can retire these credits, meaning they can never be sold on and, as a result, have a sole claim to the CO2 avoided or removed, so they can claim to have offset the CO2 they have emitted. The other option would be to trade the credits.

How Does It Work?

Participants in the voluntary carbon market include project developers, end buyers, retail traders, brokers, and standards organizations.

- Project Developers → These are the entities that create and manage projects to generate carbon credits. Examples include renewable energy projects, reforestation initiatives, and carbon capture technologies.

- End Buyers → Companies or individuals that purchase carbon credits to offset their emissions. Early adopters include tech giants, airlines, and oil and gas companies.

- Retail Traders and Brokers → They act as intermediaries, buying large volumes of credits from developers and selling them to end buyers.

- Standards Organizations → NGOs or other bodies that certify the validity and impact of carbon offset projects, ensuring they meet certain criteria such as additionality, no overestimation, and permanence.

Carbon Projects

By purchasing credits, you are funding the project's activities. Since the quality of carbon offset projects can vary, it is important to understand how they are designed, implemented, and monitored. There are a number of project types in the voluntary carbon markets. They all fundamentally serve to either avoid, reduce, or remove emissions.

Removal Projects

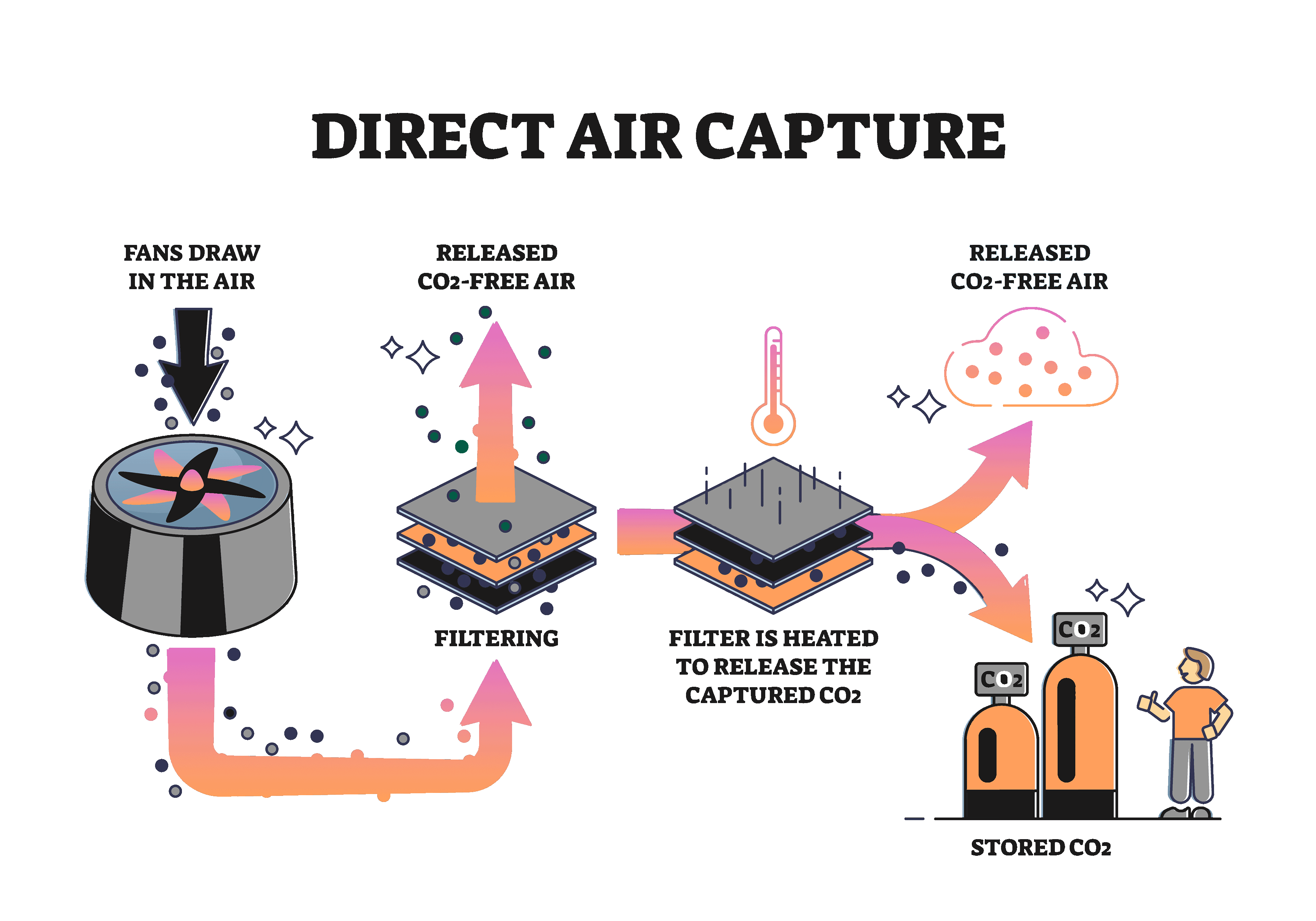

Activities that remove GHGs from the atmosphere, for example, planting a forest that will absorb CO2 as it grows, or implementing Direct Air Capture (DAC) technology.

Avoidance and Reduction Projects

Activities that reduce GHG emissions, for example, protecting a forest from deforestation or improving renewable energy generation on the grid.

Issuance of Carbon Credits

To issue carbon credits, projects must undergo a rigorous process of validation and verification of emission reductions or capture. This procedure is carried out by accredited agencies called registries, employing a standardized methodology.

A registry is a system that records, tracks, and manages the issuance, transfer, and retirement of carbon credits. It serves as a centralized database to ensure transparency, integrity, and accuracy in the accounting of these assets. Registries play a crucial role in preventing double counting of credits, verifying the authenticity of environmental claims, and providing a transparent mechanism for the trading and tracking of carbon credits and other environmental commodities. This system is essential for maintaining the credibility and efficiency of carbon and environmental markets, supporting global efforts in environmental conservation and climate change mitigation.